Today was a slow and nonprofitable day. I was 0/1 in day trades and 0/1 with swing trades. Lets start with the swing trade. this morning I took a short position in the AUDUSD on a trade technique called the 2618. The position looked to be a really good setup because it was a retest of a double top at a strong resistance area. Unfortunately a few minutes after entering the trade this mornings surprise news came out and I was stopped out on a candle that ended up rallying over 100pips. A few minutes later when things seemed to calm down a bit, I entered a day trade that also lost on a failed ABCD pattern. Afterwards I pretty much told myself that my trading day was over. Not because I lost, rather because with seeing the size of the impulse candles I knew that there would be a little to none chance of me getting anymore valid signals. I was also a little upset about the news release and mentally I felt somewhat of a revenge trading mindset coming. Therefore I felt it was best to simply back away and just be a watcher. So the lost day-trade was -96 pips putting us at -27 for the week. Let's see if we can get back into positive territory for the week. Either way the day-trading is still up 372pips for the month which I will gladly take. See you guys tomorrow. Also if your looking for some great trading ideas, charts and videos check out this site from Jason Stapleton http://forexmarketpreview.com/

0 Comments

Hey guys, today was the fist day that I decided to start using my live account for my day-trading on the 5min charts. For those who have been following, I added this strategy to my portfolio at the beginning of the month but before jumping right in with real money, I decided to trade for a few weeks with a simulation account until I became comfortable with the speed of things, as well as define what strategy I wanted to use. Because of the success I was having in my 3 weeks of sim trading (400pips) I honestly expected to start off with some losing trades simply because that's how it has usually been for me, but this was not the case. Today I was 2 for 2 on trades taken (69pips) with both being stopped out for break-even after target 1 was hit. No advanced patterns just plain old structure and ratio's. Below are some charts of what I took this morning.

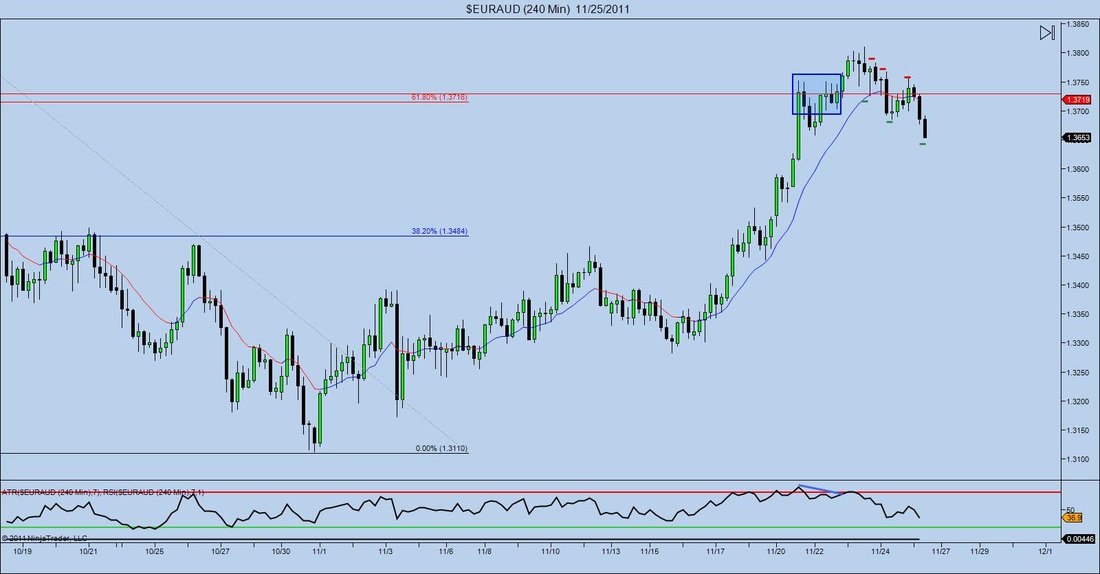

On the swing trading side i had my 2nd target hit in the EURAUD trade and have nothing else in progress. There isn't much more on my radar, but that can easily change when I do my analysis tonight. See you guys tomorrow. So last week I posted a brief piece under the "Just A Thought" section titled "Refresh & Reset". This piece basically talked about how it was good to take a break sometimes in order to relax and get a better perspective on things. In the post I talked about how I gave myself a 5 day vacation in order to avoid burning out. However, during this 5 day break I was secretly fooling around in the market, just not as a live trader.

Around this time last year I was really struggling as a trader and I was in a very bad place mentally. I had just came off a month where I took a big drawdown, only to get scared out of trading and miss a few opportunities that would have almost tripled the amount that I lost. The thought of quitting never crossed my mind, but I did start to lose confidence that I had gained from coming out of the Pro Trader course. It was at this part of the year where me as my boss, sat the me as my employee down and had a true heart to heart with myself. After a reality check I decided to get back to the basics and start the new year with a bang. When the new year began I felt fresh, relaxed and confident and my trading results reflected that as well. Therefore I decided that maybe I should work that process into my trading plan as an annual or even bi-annual type of thing. So that's what i did this past week. I won't take you through all of the details, but I basically like to go through and edit my trading plan. To so I start out my looking through my past trading logs for any notes that look to reoccur over time. If i'm able to notice a trend then I can make adjustments to my plan for the future. For example, I noticed that when trading certain patterns on lower time frames my 2nd target (61.8) was hit on basically every winning trade. Therefore I was able to make the adjustment of making the 61.8 my new 1st target in order to take advantage of more profit. I also like to take the time and go back through all of the saved videos I have from the Pro Trader course I took. Ok...well not all of them but a select few that I feel will help me out. At a quick glance it may seem like a waste of time because I've already learned the material, but I find review to be very helpful on both the technical and psychological side of things. I know a lot of you guys wern't Pro Trader clients so you don't have access t the videos but if you watch the videos on Trading Underground of the new Forex Market Preview site, i'm sure you will have similar results. Anyway the point, I was always told that trading is a skill and being a former athlete, I understand how important practicing is to raising your skill level. With that being said it's always good to take some time out and review the basics. If anything , it at least gives you some time away from the real markets so you can come back in with a clearer prespective on things. Hey guys, with the holiday and everything I've decided to stay out of the markets until next week. However there is still a trade that I had on the table from earlier this week that i'm keeping an eye on and managing. If you remember, I mentioned a short position that I took on EURAUD that I didn't feel to good about. Well this trade came within 6 pips of stopping me out and basically told me I was wrong (pattern wise at least). It has since turned over in my direction taking me from down 89pips to plus 60 or so now. My targets are still a while away so I ca't just take the money and run (that would install a bad habit), but I can protect myself. How I protect myself is by trailing my stops at structure. Therefore even if I am wrong and the move was a simply a minor retracement before shooting back up I won't lose as much money. Below are both the 240min & 60min charts of this trade to hopefully demonstrate how I was able to trail this position. And if you want to read more about this trade please check one of the past post.

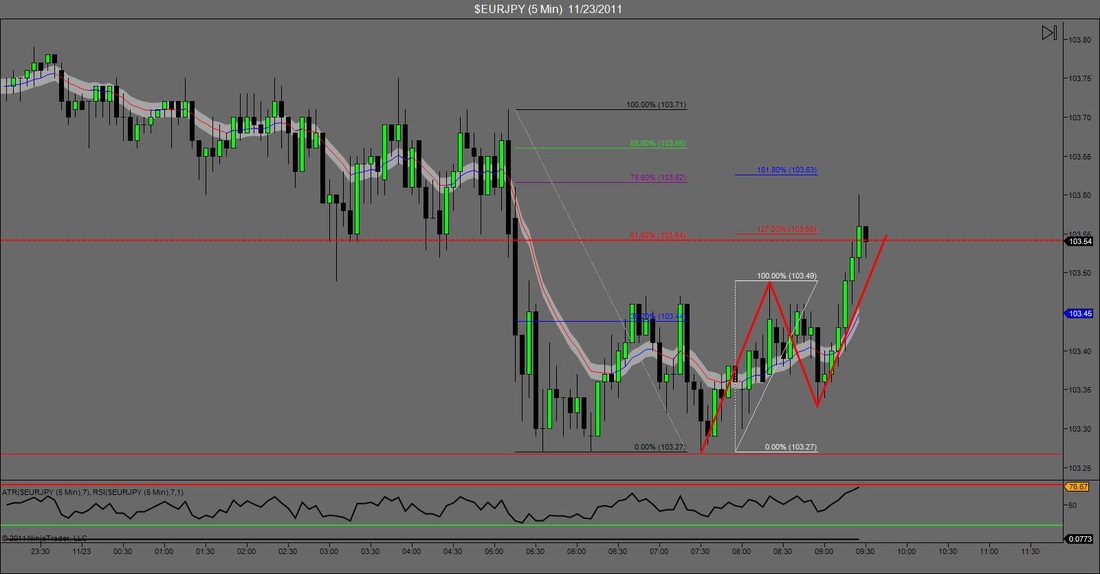

As the title says, today was an interesting day. With Thanksgiving being tomorrow I honestly didn't expect to get any moves and that prediction did hold up for the most part. in fact I only has one valid signal complete. However I was 1 for 2 on trades today. How does that happen? Let me explain. I'll post a chart below, but long story short I took a pretty good looking trade on the EURJPY 5min, There was an ABCD pattern that met at a 1.272 extension and a .618 retracement. Great stuff right? As always (on the 5min charts) my initial target is the .618 retracement of the move and my stop is half of that giving me a 2:1. After setting my limit orders I went ahead and placed my stop. A few minutes later when I clicked the chart to see what progress price action had made, I noticed that my Buy Stop order was gone, but price never reached where I had placed it. Then it hit me...The Spread, I had forgotten to account for the spread. "Idiot" I told myself. Fortunately I was able to re-order the same trade at market and watch it rollover for a target 1 & 2 winner. Because I am used to trading on longer timeframes the spread is something that I never really took into account. I mean let's just be honest, when you're stops are a hundred pips away, you should be safe enough so that 1 or 2 pips doesn't make that big of a difference. However, on a 5min chart where targets 1 was only 14pips, it does.

In conclusion I'm not upset at all about goofing on the 1st trade because it allowed me to realize something important that had slipped my mind. And that learning experience is much more valuable than the harsh agony of losing 12pips. So at the end of the day I was 1 for 2 today yielding a total of 34 pips. I'm shutting things down for the week so that makes the week total -70pips. Hey loosing weeks happen, and when the two previous weeks were +298 and +171, losing 70pips is just the price of doing business. have a great Thanksgiving and I'll be back on Monday. :-) So I had 3 valid trade setups on my day-trading portfolio. The first was a Gartley pattern on the AUDUSD and the other 2 were structure and ratio based setups on the NZDUSD and the GBPUSD. As of writing this both the GBPUSD and AUDUSD trades were losers and the NZDUSD is still in progress roaming around the breakeven mark. With that being said I have no regrets over all 3 trades so all in all it has been a successful day because I didn't make any mistakes. There were a few other Gartley and Bat patterns that were close to completing but the market reversed which invalidated the entries.

On the longer term side of things, I took a short entry on EURAUD because of a double top with RSI divergence. Personally I wasn't really a fan of the setup due t the lack of structure, but when I added up my score (CTS System) it told me that I had to enter. So we'll see how it plays out. In the past its often the trades that I don't want to be that win so hopefully that's the case. On the flip side there was a really nice setup on the EURGBP that I wanted to get involved in but couldn't because of my rules. I still may have a chance later in time if the market decides to comeback and retest but we'll just have to wait and see. So that's about it for today. The two longer term positions in the USDCH and NZDUSD are still in progress so the pip total for today is -72 with 1 trade still going. Since I didn't trade yesterday that's the weeks total as well. Since I've been a pretty active day trader as of late, I decided that it might be beneficial to provide a daily recap of how things went. I got the idea from reading through some of Norman Hallet's journaling techniques and think that writing about my day will provide a sort of trading self-reflection which will hopefully allow me to grow. So we'll see how long I stick with it, but I actually enjoy writing so here we go!

Today was a pretty slow day in the market for me. With that being said I was still able to pull out some profits so that's always a plus. Although I had a lot of setups on my radar, I was only able to get filled on a single trade. A few trades never completed and one came within a single tick of my entry before reversing into what would have been a profitable trade. The one trade I did get involved in was a bullish AB=CD pattern on the USDCAD which hit target 1 for 39 pips and is currently still in the progress of trying to hit target 2 for 83 pips or stop me out for break-even. So in the worst case scenerio its a +39 pip day which ups the weeks total (day-trading wise) to +98pips. We'll see how tomorrow goes but if we can stay in the positive territory then that makes me 2 for 2 since switching to a day-trading technique 2 weeks ago. We'll see though, I never count my eggs. Other than that i'm also involved in a few longer term swing trades on the EURUSD. AUDUSD, USDCHF and the AUDNZD. I was recently approached with the opportunity to share my trading and help other traders on a daily basis by operating a live room. Think of it was being like an online conference call or webinar for a few hours every-day. In order to provide enough trading examples I will most likely be trading on a timeframe that offers a good amount of "action". Currently I consider myself a swing trader and execute the majority of my trades off of the 240min & hourly charts. But now I am working on making the switch to the 15min & 5min charts. It has only been a week but here is what I've learned so far.

Despite what timeframe you are on the same basic principles apply. AB=CD's still happen, double tops and bottoms still form, and advanced patterns like Gartley's or Bats still occur. It just all seems to happen at a blink of the eye. Because I'm used to having hours, days and even weeks in some cases between moves, watching action on the 5min chart seems like someone is holding down the Fast-Forward button as I trade. With that being said I kind of like it. One of my downfalls as a trader is my attention span. During those days and weeks when nothing is going on in the market, I often find myself over analyzing the market and forcing myself to find a trading opportunity. I don't do this as much as I used to in the past because I understand the consequences of doing so, but I still feel that urge sometimes. Trading on the 5min chart on a 7 pair portfolio I am able to find a valid setup every-day. Please keep in mind that I've only been actively watching them during the U.S. session for a few days, but as I did some back-testing I've found a few trading opportunities each day. This excites me, because as I full-time trader it gives me some action every day, but there is also a downside. As I mentioned before, compared to the 4hr charts, trading on the 5min ones are like watching the market at light speed. This means that I really have to be on point with my analysis and keep a certain level of focus. In the few days that I've been Sim-Trading on these charts I've found myself rushing to draw fibs and lines before price action reaches my predicted entry point. I've also found myself missing a few trades. I have no doubt that the more time I spend on this timeframe the more I'll get used to it and I'll be able to enter my trading Matrix (that's what I call it when everything seems to slow down as if you were in some type of zone, if you've seen any of the Matrix Trilogy then you'll understand). Lastly I think that trading on this timeframe will help my swing trading as well. Last week at sat in on a live trading room hosted by Todd Brown of www.triplethreattrading.com and he mentioned a study he read about NBA referees. in this study the ref's said that they would practice their craft by watching game film at a sped up pace and attempt to make all of the calls as if it were a regular game. They did this so that when they got in the real game everything seemed slower and not as much as a shock. I'm looking at my situation as being the same. So that's all for now I'm excited about this new test and so far it's been going pretty well. I've been Sim-trading since Monday and as of this second (have 2 current trades waiting to hit Target 2) I'm up about 250pips. In hindsight I wish I was trading these setups in my real account, but if I learned anything it's been to always test before hopping into something new. I still have to do some more paper-trading and back-testing before settling on what I want to trade, and what profit targets work the best, but it's good to see that I'm able to make the adjustment with limited issues. |

RSS Feed

RSS Feed