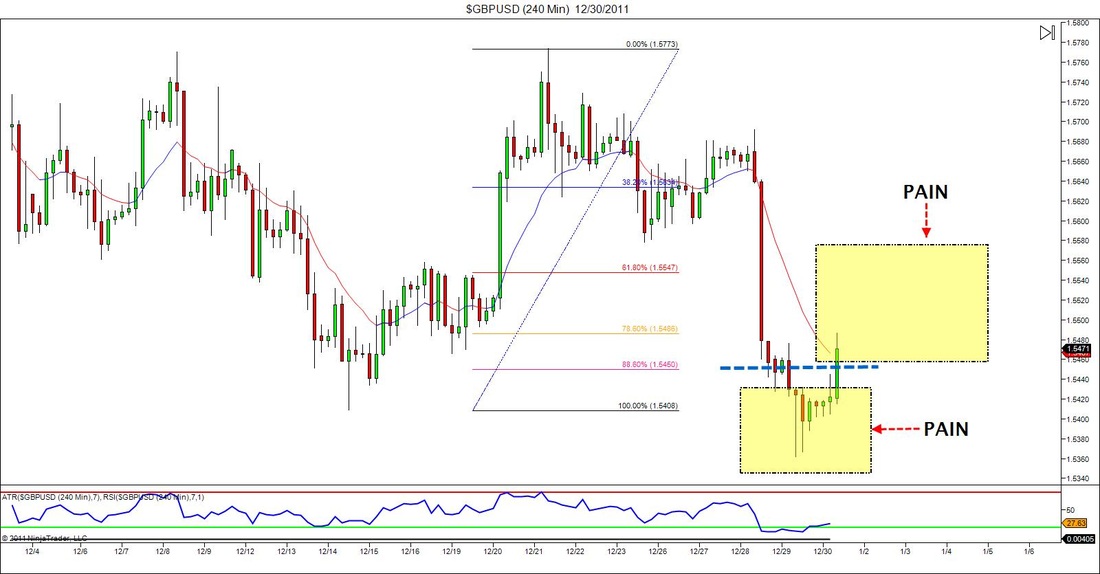

Dealing with the pain of trading is probably the biggest factor that separates a profitable trader from a losing trader. If you've been following my Forex journey then you'll remember that pain was what caused me to almost blow out an account last year and stop trading. One of the biggest questions young traders ask themselves is how do I get rid of the pain. Well the answer to that is that you don't. Like anything out your control in life you simply learn to deal with it. Now I've only been seriously trading for about a year and a half, so I would assume that the more experience you have in the markets, the easier it becomes to deal with the pain since you know it's coming, but I still don't think it ever completely goes away. To me at least there are two main types of pain. The first is the type of pain you have to deal with when the market makes that big candle in the opposite direction of your position then proceeds to trade right above your stop , teasing you and almost daring you to just close out your trade. The second type of pain occurs in the exact opposite direction.

So I already spoke on the type of pain you have to deal with when your trade is in the red and your praying, yelling and second guessing yourself about entering the trade. The second type of pain is the pain that occurs when you're in that area where you're in positive territory but still have a ways to go before you hit your target. This is the type of pain when you start to question your targets and get that horrible temptation that I'm sure have all been guilty of at some point in our trading career, and that is taking profits off too early. I forget the exact details but I have a good friend that had a horrible month where he was guilty of this trading sin and it became contagious. It started off as a onetime thing, then before he knew it he was doing it on almost every trade and ended up missing out on nearly 500 pips total because of it.

So what's the solution to both types of pain you ask. NOTHING, just deal with it. Just kidding, in all seriousness, the key is simply having confidence in your abilities. It's when you start second guessing your decisions that you start giving into the pain and fear and end up doing something dumb, only to be mad about it later. My advice is turn off your charts. If you can't see it, then it won't bother you as much.

Coming back to the market has been a little more difficult than I expected. I'm still not trading live (with the exception of a few good setups I took today on the longer term charts), but I wanted to get myself back into the trading zone. It doesn't seem like it but many of us traders go about 50 weeks straight analyzing the market the same way, watching the same pairs, on the same timeframes, during the same time each day. Needless to say we develop a pretty good routine that gives us a unique comfort level as a trader which adds to our confidence, which in then leads us to seeing better results. Or at least that's how it should work.

Being away from live markets for the past two weeks had me very anxious to get back in and start adjusting my eyes so I'd be ready for the new trading year. I immediately started trying to analyze every little move the market made and the result were trades with targets to small and stops being short which lead to me being me getting stopped out on the majority of those trades. I then started over analyzing the market to the point where I wasn't able to get involved at all. At this point I began to get a little frustrated at the fact that I just felt out of my trading groove as I like to call it. That's when I shut my charts off and decided to re-read my trading plan and get my mental situation under control. After bringing myself back down to earth I realized two things. First, I realized that I was trying to do too much, and secondly I realized that I was trying to do too much at a time where the markets were not doing much either. It was a bad combination, and if this were a year ago I probably would have blown half an account trying to make it work instead of realizing what my issues were.

The lesson I'm trying to relay, is that once you have a plan or system that works for you, trading is very easy. Correction, trading CAN be very easy and your system or strategy is probably the easiest part to get mastered, because that is the one consistent factor. What changes is your day to day mental state and ability to deal with the wild ride the market will give you. My advice would be don't try and do too much, or do too little. Stick to what brought you success in the past and don't try to get fancy. The markets will do what they want to do, when they want to do it. As my friend over at Triple Threat Trading often says "our job is to wait until the money is sitting on the table for us to pick up."

Hey guys, if you read my last post then you're aware that my trading is done for 2011. (Sigh), finally an opportunity to get some good sleep. No more waking up early, no more wondering what's happening in the overnight session, no more rushing breakfast so can get back to the computers right? Although I have been able to sleep with a clear mind knowing I don't have any trades on the table, and I have been able to relax and make some better tasting breakfasts, I have still been waking up at close to my normal time and I have still been in the market. Just not as much.

The first thing I did this week was to go back through the 8 pairs in my day-trading portfolio and see what the results would have been if I would have been able to trade last week. I didn't do this because I was upset, or wanted to see how much profit I missed. Trust me I'm quite fine with not trading because that means I'm not losing money. Rather, as always, I wanted to continue to train my eyes in identifying patterns and different setups. Anyway here are the results.

Mon: -30pips, Tues: +66pips, Wed: --48pips, Thurs: +51pips, Fri: +92pips,

Giving us a total of +131pips for the week. I've only been trading on the 5min charts since the second week of November and I think that I've had only 1 negative week. Honestly this is a little shocking, because as a swing trader are drawdowns are often longer. Ending the year on a positive note (unlike last year) has me pretty pumped for 2012, add to that the fact that I'll be getting the chance to help train and work with others and that's a gift in itself. I'm sure i'll be writing again before the season is over but if not I want to wish you a happy holidays and hopefully, like me, you can use this down time to work and try and improve some aspect of your trading.

Early Monday morning I left for an annual convention that was hosted in San Antonio Texas. This was my 3rd consecutive year attending this convention so I had a pretty good idea of the event schedule and knew that I would have limited time to trade. My goal was to wake up early and get a few hours of day trading in before the symposiums began and then whenever I had some free time take a look at some longer term charts. Unfortunately I did not get the chance to do either. Other than watching about half of Jason Stapleton's Forex Market Preview, I did not see another chart the entire week. At first this was a little upsetting because I knew that this week was basically the last legit trading week of the year before the Holidays begin so I was hoping to get a little more action in, but as the week went on I thought to myself that this could in fact be a blessing in disguise since trading in this situation would have put me out of my routine which could have been a negative. I've had times in the past where I tried to rush my trading and it never ended well, so I decided it would be best just to take a week off and focus on what I was at the convention for. With trading being shut down for the most part for the remainder of the year, I like to use this time to get some behind the scenes work done. This means going back through charts and working on sharpening my recognition skills as well as back testing on another system I would like to work into my portfolio called the "Big Mo" (you can check it out at http://www.triplethreattrading.com/) My goal is to have a 4 market portfolio using that system and cut down the pairs I swing trade from 22 to between 9-12 or 16 max. This way I can concentrate a little more on each individual pair as well as not have to worry about contrasting signals since I'm a Counter Trent Trader and the "Big Mo" is a trend following system. So that's my homework assignment for the holiday break. On another note, during my seminar I got a lot of work done on a 6 part series I'm releasing next week titled The House: Your Blueprint To Success. I'm pretty excited about this because I've never written this much before, but I think it will be pretty interesting. I may even post the Preface today or this weekend. Hopefully that will keep you guys entertained while the trading is slow. Enjoy your weekend. -Akil @IambusinessTR

Sorry for being a day late guys but yesterday was pretty busy for me outside of trading. As far as my day-trading well it was a very slow day again. Seems like most of the action was on Monday and Tuesday. Looking back at the charts the European session had some pretty good action but I don't start until New York opens so i couldn't take advantage. With that being said I had one loser on the GBPUSD for a total of -48pips. With our previous total being at +193 that ends our week in the positive once again for a total of +145 which isn't to bad. I don't have a numerical goal in mind when it comes to the day trading simply because I don't want to put myself in the position where I feel as if I have to chase trades in order to reach it. Especially if we get off to a slow start. But I'll be satisfied with 100pips a week any day. Keep in mind pips aren't dollars so what's 100pips trading 1 mini lot is $100 but when you start growing your account and are able to trade even 5mini lots, that same 100pip week is suddenly $500 dollars.

I'll be in a convention all next week so I doubt I'll have any time to day-trade :-( I'll try but simply looking at the schedule of events I may only have 2 hrs a day unless I want to try and wake up for Europe. Who knows I may just take off. That's neither here or there. Another positive week in the books! That makes 3 in a row which is a really good sign. Especially for those who will be joining me in January. If you haven't heard about what's happening in January then just be on the lookout. It's going to be BIG! have a great weekend and stay warm for you Northeastern folks like myself.

Today was another uneventful day for me day-trading but a very busy one in the swing trading department. On the day trading side of things there was only 1 valid trading signal that ended up being stopped out for break even. Well technically -2pips because of the spread, but you get what I'm saying. That same trade eventually rolled over to what would have been a winner, but rules are rules and I'd rather protect against a loss then shoot for a win.

On that same note today's action (and there was a lot of it with all of the news that came out) caused me to close all 4 of my open swing trades. I closed 2 of my swing trades on what I was taught to be called a "graceful exit". I was involved in these trades on the 4hr chart from last week that went from barely being stopped (which was over a 100pips away) to putting me back into the profit zone, to barely being stopped out again. When analyzing the market I could see that the market clearly wasn't doing what I predicted, as my original structure level was broken and closed below. Therefore I decided to save some face and just close my orders for break even on one and -20 on another, which is basically break even when seeing where the stops and targets were at. The one swing trade that did get me a little upset was one I had placed last week on the NZDUSD 4hr chart. There had been a triple top that the market had refused to break for about a week. For those who like to play channels there was a great opportunity as the market continued to bounce back and fourth. It then rallied this morning with the new events only to be sucked back down and break the channel towards the down side. I'm not mad about the trade or where I had my stops at, i just hate when a market makes an impulse move off a news event only to reverse. To me this means that I was right but I didn't get a chance to profit. Same as I were to identify a great trade setup but not take it. Anyway thats the end of my rant for the day. Underneath are some charts from the day trade (grey) and the look at the NZDUSD trade in white.

We've always been taught that one of the most critical skills in life is having the ability to network with others. I graduated from college when all of this economic stuff started happening (or coming to the light I should say) and I was told that my chance of getting a job depended more on who I knew than what my degree said. This proved to be true as I remember myself sending out resume after resume after resume to no prevail. Although networking is looked at as being the key to success whether it be getting a job, or moving up in the ranks. It's sort of like a double edged sword in the trading business.

When I first started trading, (like many, in hindsight) I had no idea what I was doing. I had moving averages in different colors and a crap load of indicators with pivot points and trend lines. It was bad. I'm not saying that using that stuff is bad because many people make some pretty good profits from strategies as such. However, personally I just had them on my charts because every time I would read about something new, I would add it thinking it would make my trading more efficient. Because I had no real clue about what I was doing I would often venture into different chat forums to see what other people were doing. I thought that if I could follow and network with some other traders it would help me improve...FALSE! What ended up happening was me becoming intimidated and self conscious trading wise. Every time somebody would post something that I didn't see or know about I would feel lost. When I would ask them about why they were entering there or looking at that specific point, I would get a reply that made me feel stupid. Now to their credit there were some nice people in these forums but, the majority weren't trying to help a novice trader. rather they were trying to boast about how good they were often at our expense. Add to that, whenever I would post an idea it would be shot down right away. To make a long story short it was an overall bad experience.

I bring this up because recently I have been sucked back into networking without even realizing it. However, it has been a little different and a really positive experience. As you know trading is a very lonely career as well as being one that's hard to understand by anybody that doesn't trade. As my friend Eric said the other day

"The road is a long journey, but very fun and I appreciate networking with individuals like yourself who are similar minded to keep me sharp =) Far too many people give me blank stares when I tell them I forex trade. and even fewer understand harmonic day trading. lol. I love the internet! =)"

This boredom and lack of knowledge for what we do is one of the reasons I started writing this blog last year. The main reason was because I looked at it as a way of giving back. A way to show people that they could do it too and give them a chance to learn from the MANY mistakes I've made. But deep down I was also looking and hoping to get some type of social interaction from people that are familiar with the topics I was discussing. This changed as soon as I started writing my blog for Trading Underground as well as promoting it on Google +. These two outlets have allowed me to meet other good traders that have really helped me out in numerous ways. What I enjoy most about the people I have met is that we all seem to be on the same page when it comes to things. Since we all have the same overall goal, which is to become a better trader one day at a time, we all try to help each other out rather than brag about our personal glories and put each other down. I honestly don't like to hear about different entries and stops and targets from others. I'd rather see a chart that they're looking at, hear a new idea/thought that they might have about a strategy or a trading time frame, or discuss a trading issue. This is what I use networking for now and I think it has allowed me to grow as a trader. i look forward to meeting more of you guys down the road.

What a day! What a day! I'll tell you what guys, today was one of those days where I really feel like I earned my paycheck. Sometimes the markets can become very dull and slow, but today it seemed as if I was off to the races as soon as I started. Although I don't start my day-trading until 8:00am est. I'm up at 6:30 every morning to do some longer term analysis and have some "me" time for breakfast and stuff. While doing my swing trading analysis I noticed a pretty good setup occurring on the CADCHF chart. It was an opportunity to get involved in what I was taught to be called a "26-18" trade. I haven't traded this setup in a while s o before entering I had to scramble through my old notes in order to find out where to place stops and targets at. By the time I placed this trade it was almost 8am so I had to hurry to grab a bite to eat. When I started looking at my day-trading charts I immediately noticed about 3 abcd patterns that had already hit their entry points so I assumed the day would be un-eventful. However when I started looking a little deeper I found 3 other setups that were still valid. One was a potential butterfly that never completed, another was a double top which ended up stopping me out for break even and one was an abcd pattern on USDCAD which is shown below in the grey charts. The "26-18" trade on the CADCHF & the USDCAD trade both ended up being 2 target winners totaling 195pips of profit. Not bad for a few hours worth of work. Yesterday would have been a big day, but of course this would have been the first week following my decision not to trade on Monday's (may have to rethink hat). Anyway we're off to a great start with 195 for the week and I feel 100% comfortable on this time frame now. I'm really excited about the new year for reasons I won't discuss yet. But I appreciate you guys following me on this journey and hopefully you'll continue to do so. P.S. If you have questions about what the "26-18" trade is and how you can learn about it. Watch the FREE video on my mentor Jason Stapleton's site. ( http://forexmarketpreview.com/)

Take a look at the chart above for a second and let me know what you see..... Most people will respond nothing really.Experienced traders will either say a triple top high or an Abcd pattern. However if you look closely or at the chart below there is actually a beautiful Gartley pattern completion. Earlier today a good trader named Andre send me some charts of stuff he was looking at late last week. When looking at this charts I decided to open up mine simply to get some practice at see if I had similar notes marked off. When I opened up his chart on the EURUSD with a Gartley marked off I became confused because not only did I miss it, but it wasn't even on my radar. I didn't trade on Friday so I wasn't upset that I missed it, but when it comes to advanced patterns like such, we should be able to have them predicted hours if not days in advance. So why did I miss it? I missed it because on that particular pair I was only looking at the 4hr chart. The chart that Andre sent me was a 2hr chart and when I went down to the 1hr chart that pattern was even clearer.

When I do my market analysis I often only look at a pair on a single time frame only checking down to a lower on if I want a clearer picture of something that was previously identified. Seeing these charts, and noticing how my eyes didn't pick up this pattern at all shows me that maybe I don need to start looking at both time frames (4hr & 1hr) before going on to the next pair. My goal is to become a master trader and great technical analysis. Hopefully I took another positive step in that direction today.

Again thanks to Andre P. for bringing my attention to this.

Slooooooowwwwww day today. Only took one trade and it happened to be a target 1 winner for +17pips. With that being said I was really excited today because the trade I took was different from what I usually do which says a lot for the extra work (training) I've been putting in on my structure analysis skills. I'll do a full explanation of the trade in a Chart Talk post so make sure you check out that section. Anyway the +17pips puts us at a total of (-10pips) for the week. If you want to be technical that would make it (-10pips) for the month as well,but I always like to start fresh so i'm counting this week as being a November week so my total is still +390. I'm undecided on whether I want to trade tomorrow or not. If you've been involved in the market for a while then you're aware that the 1st Friday of every month contains the Non-Farm Payroll announcement which is known to move the market in a major way. During my swing trading I could car less because things usually balance themselves back out eventually and get back on track with the normal trend. However on a 5min chart, an impulsive 50-100 pips move would really have a major effect on my positions. Therefore a may just play the role of a fan and watch. Or at least pick out a window before and after the news release where I get out. We'll see.

|

RSS Feed

RSS Feed