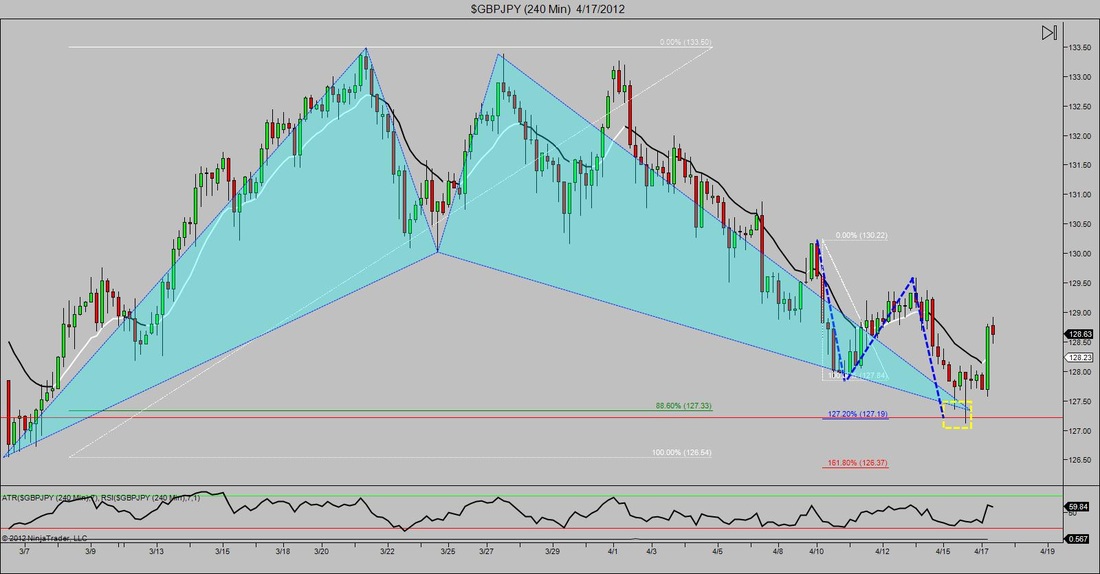

Hey traders, it's been a while since I've done a chart talk post as most of my analysis has been going towards "Syndicate" members. However, I was able to pull something up today that I thought would make fro a great lesson. Have you ever had a trade that looked very attractive but for one reason or another didn't meet your rules for entry? Because I have pretty strict rules on what levels my advanced patterns need to hit, I often am faced with this issue. The chart below is an example of a bat pattern. Now in this case my rules were hit but for the sake of this post let's pretend that they were not. Even though the pattern may have not triggered your rules for entry you'll notice that before it completes another pattern is formed. An AB=CD completion at the exact level that your bat entry would be at. Therefore even though you can't "officially" trade it as a bat pattern, you can get the same type of trade off of a CTS type trade looking at the ABCD at fib confluence. This just goes to prove that you should never give up on a trade.

0 Comments

|

RSS Feed

RSS Feed