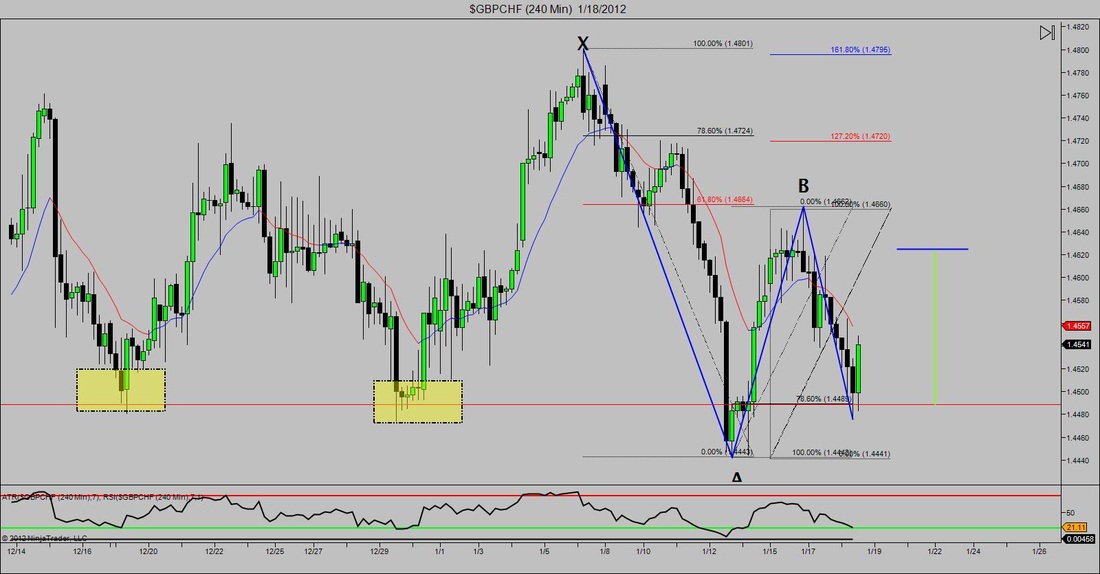

Structure, structure, structure. One of the most important lessons I learned in the Pro Trader Course was how important structure actually is. I won't go into all of that in this post but I wanted to show a brief update of a trade we looked at in the Live Room. I took this Gartley pattern last week and as I opened up my charts today I saw that trade was in the black by over 100pips. Unfortunately this means nothing because targets haven't been hit. Placing proper targets and stops are a crucial part to being a successful trader. Rather, I should say placing consistent targets and stops are. This is why structure is so important. Not only doesn't it help you get into potentially profitable trading opportunities, but it also helps us to predict where the market will (for better or for worse) telling us where to place good targets and stops. For those involved in this trade, I applaud you for hanging in there and hopefully we'll get our targets filled. See you guys Tuesday in the room.

0 Comments

This chart sort of speaks for itself. It's difficult to see since I didn't zoom all the way out but as you can see, there are about 3 Fib points (2 retracements & 1 extension) lining up at the same level. Add to that there is also a potential ABCD pattern completion at the same level. Scroll left and you'll begin to see a few structural levels around that potential reversal area as well. Needless to say the market is giving us a key area to watch, the only question is do we enter? And if so how do we enter? I can't answer that question for you since we all use different rules, but hopefully we'll all get the opportunity to make some money if the market does give us reason at this point. When going through my charts this morning I noticed a few pairs with similar setups as well.

Below is an example of a setup that many traders (well at least traders familiar with the T2T bootcamp) know as being an aggressive "c" buy. Basically on a trade like this your predicting the completion of an advanced pattern and jumping on the train early. What makes it aggressive is that we have no idea whether the pattern is going to complete or not. However, if you look left there is some pretty good structure lined up exactly at where price action hesitated at, along with a fib retracement. So far the trade looks pretty good, but as we know, there is no telling what the market will do second to second so we'll have to

Above is a pretty cool image that I noticed today while showing some trading examples during the Live Room. What's funny is that I noticed all three of these patterns separately when they were forming, and I was actually involved in one, but I never drew them all out together, I personally think it's really cool how the market moves and action like this really makes you believe in the power of technical analysis and market harmonics. Even though its in the middle the red pattern was the first to occur which was a gartley pattern. That gartley then completed into a bat pattern entry, which then completed and formed another gartley. Imagine the profits available for somebody that was able to hop on board all three. CRAZ

Below are examples of two different pairs with two valid setups. However I am only involved in one of them.

Take a guess....... If you guessed that I pulled the trigger on the first set of pictures and not the second then you are correct. I have been watching the potential Gartley pattern on the USDCAD for a while now. The other day I also noticed that an ABCD pattern would also complete at the exact same point as the Gartley. This tells me (and this is only my opinion) that the market wants to go lower. So when I zoomed down to a lower time frame and saw another Gartley pattern putting me in the same direction as my overall prediction, I couldn't pass it up. If you read my post from Dec. 28th, then you'll noticed that I did the same thing with the GBPUSD and that trade ended up rolling over for 200pips, then reversing at the bigger pattern for another 200pips. Does that mean that this trade will do the same thing...Heck No, but I'm not going to pass on this opportunity. With that being said I did pass on the traded noted in the second set of pictures. In this example there was a double top that formed on the AUDUSD at an ABCD completion at some ratio confluence. Yeah I know, sounds pretty darn good, However if you look at the larger time frame chart, I was also predicting a bigger pattern to form and I felt that this move was strictly a little tease. When I woke up this morning I saw that it had rolled over a little bit but my first targets would have to be below that structure area to the left and well let's just say I'm more willing to sit out of a good trade and watch, then be involved in a trade that I don't feel comfortable with. Both trades have great reasons to enter and great reasons to stay away, whether you pull the trigger Looking at the USDCAD I see multiple signals that give me a good reason to eventually get long on. I've been looking out for a Gartley pattern since December. It's not the prettiest thing in the world but it does offer a better risk reward ratio if it does complete. When looking my charts this morning i also noticed an AB=CD pattern that would complete around the same area. One of the things that moves the market it trader psychology, so seeing 2 different signals that complete at the same area, give me a little more confidence (not that it matters) that if price action does reach this point, it may turn around.

This is going to be a really brief post but I wanted to throw in an update from the trade from last week. Obviously it has reversed (which is positive for those who are going long), but I wanted to show this chart so you can see how structure plays a role in where the market likes to go. Big rally, followed by some consolidation at structure. Followed by another rally, and now I expect the market to consolidate once again. If you are able to get a good idea of where the market wants to go, then it makes it a lot easier to stomach longer term trades as well as intelligently manage your stops and targets.

P.S. Starting next Monday I will be working with Triple Threat Trading & T2 University running a live trading room. There will be a free 2 week trial so please check it out. https://t2trading.tv/ratio |

RSS Feed

RSS Feed