Recently in a training session for Syndicate members Jason asked one of his classics: “How can you expect to be a consistently profitable trader if you are not consistent in how you trade, in how you approach the markets day in and day out?”

Sounds like a remarkably simple question? Most heavy questions have that ring about them. And most heavy questions require a heavyweight answer.

Ironically, asking a few more questions may help us arrive at a heavyweight answer.

For example, you may ask, ok how do I gain consistency?

In order to have consistency you need to have belief in a solid game plan.

Ok, so how do I develop a solid game plan and how do I create belief in that plan?

A SOLID GAME PLAN COMES FROM RAW TRAINING. BELIEF COMES FROM RAW TRAINING.

RAW TRAINING comes from “practice, drill, rehearse”, from doing it over and over and over again, relentlessly, until its second nature. Until it’s easy. CAPISCE.

Ok, ok, how do I apply the principle of raw training to my trading?

One effective way is to go lower, to go where the repetition is, where it’s so fast and intense if you blink you miss out... lower time frame trading!

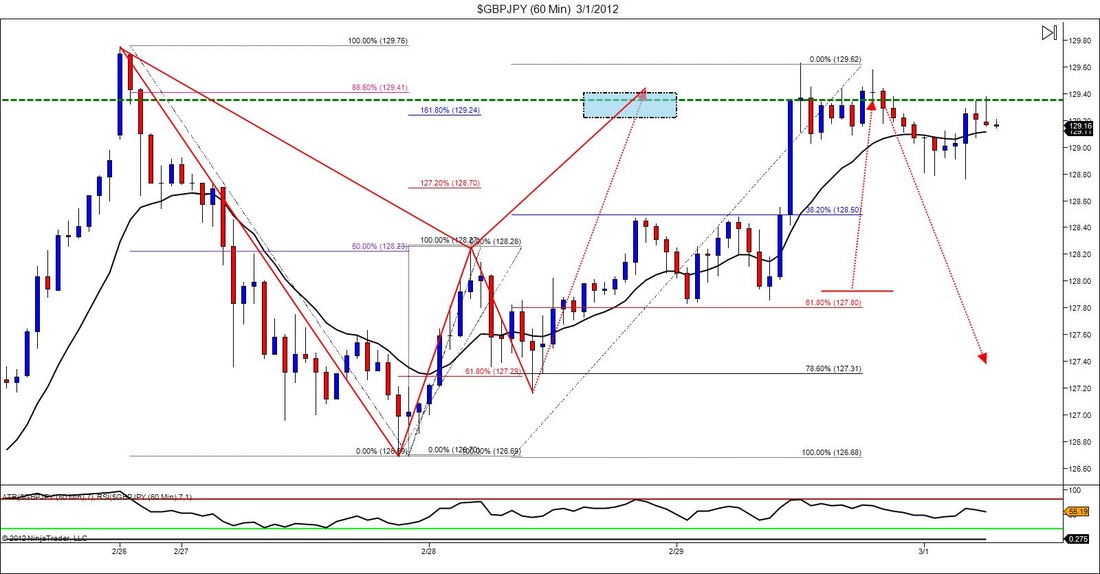

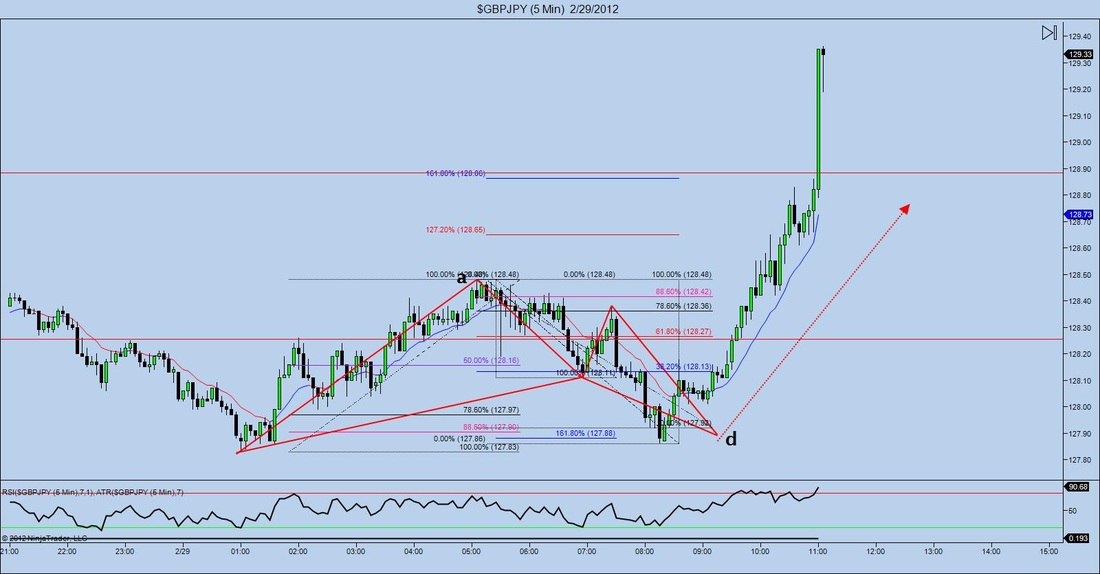

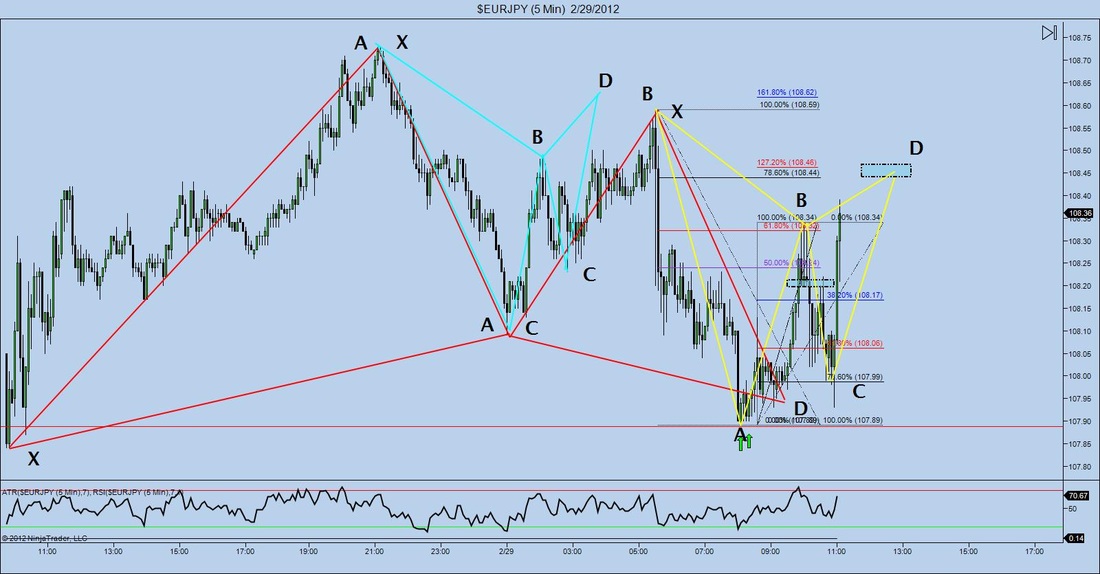

Akil’s live trading room is designed to do just that. Harmonic events like bats, gartleys, ab=cd’s, crabs, bflys, etc. may sound exotic, but they consistently appear and offer you a clear edge.

Being in Akil’s room has inspired me to go lower and what I’m finding is blowing my mind.

However, all the talk in the world can’t inspire as much as vivid examples of the real thing. So here I have provided 13 or so lower time frame harmonic events caught by me in real time during the second week of March.

The purpose is to show you the incredible repetitive nature of these harmonic events and to impress on you how going to the lower time frame is an intense and quick way to engage in some raw training and some raw trading.

So bringing it full circle, in a nutshell, the heavyweight answer is: Repetitive Raw Training!

Andre

RSS Feed

RSS Feed