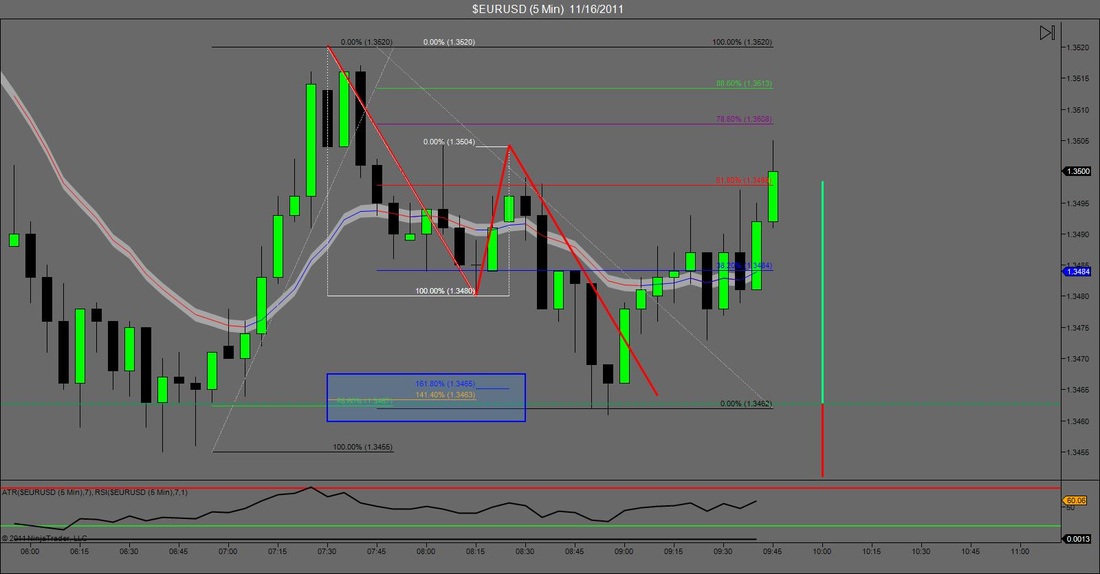

On the EURUSD 15min I was originally looking for an advanced pattern such as a gartley or a bat. However the market retraced too far to give me a valid signal by my rules. So I decided to zoom down to the 5 min chart and as always started drawing AB=CD patterns. I noticed that if it was going to complete it would stop right at the previous retracement which I deemed as structure. I then drew in some fibonacci extensions, inversions and a retracement from the original move and as you can see they all lined up at the same area. Needless to say I got involved. The rest speaks for itself.

So the coolest thing happened today. I was attending a free webinar hosted by a great trader named Todd Brown from Triple Threat Trading. In this webinar he brought up a chart from a former client and told me that I might be interested in looking at it since I am a ration based trader as well. When looking at the chart I noticed that it looked familiar and when looking back at my screen I noticed that I indeed was already involved in the exact same trade and the exact same point, and had already hit profit as well. I personally never try to base my trades off others analyses but it was pretty cool to see that three traders could see exactly the same thing on two different time frames, have the same entry and snag the same profits. Anyway let's take a look at the actual trade.

On the EURUSD 15min I was originally looking for an advanced pattern such as a gartley or a bat. However the market retraced too far to give me a valid signal by my rules. So I decided to zoom down to the 5 min chart and as always started drawing AB=CD patterns. I noticed that if it was going to complete it would stop right at the previous retracement which I deemed as structure. I then drew in some fibonacci extensions, inversions and a retracement from the original move and as you can see they all lined up at the same area. Needless to say I got involved. The rest speaks for itself.

0 Comments

It has been awhile since I've posted anything, but in all honesty there hasn't been much going on in the market, unless you're a channel trader, then you've probably had a field day with some of these pairs. Anyway, things finally seemed to start moving again over the past few days and while going through my PM analysis I noticed a potential reversal zone to watch on this chart. Now in no way am I saying or predicting that the market will indeed reverse at this point but there is some interesting Fibonacci ratio confluence between the 109.40's & 109.60's area. The Fibs I took were a the 1.272 extension the the most recent up move (A-B) & a 1.618 inversion of the retracement of that move (C-B). There is also a 0.382 retracement of the latest down move measured from a daily chart. Obviously you can't see it on this chart but trust me it's there. Do I have a sell limit placed at this zone?....Nope. But I will be keeping my eye on it and keep building my entry reasons as/if price action decides to reach it. There is some minor support near that zone as well which is a plus, but on the down side, if this pattern decides to complete a C-D move that is equal to A-B (giving us an AB=CD pattern) then that will take us to a much higher level which has some very good structure of it's own. We'l just have to wait and see what happens.

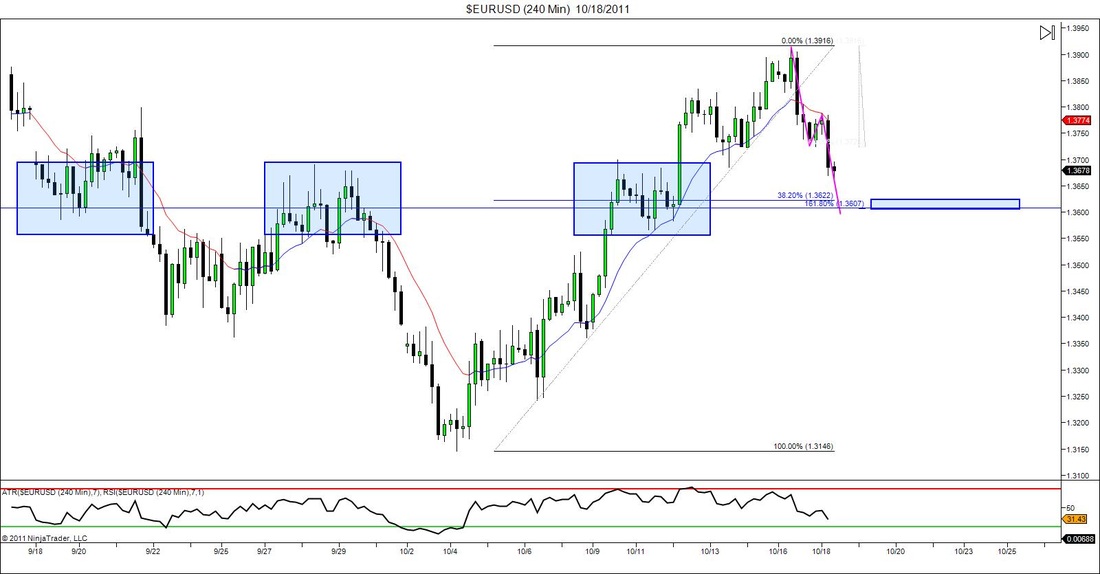

Not much in the market I'm excited over but that doesn't stop me from drawing in lines and practicing my technical analysis. After-all it is a skill. Anyway with this chart I simply drew in a "What If" AB=CD pattern and saw that would indeed complete at a 1.618 fib extension which is always a good sign. this extension also lines up in an area very close to a 38.2 retracement level of the impulse leg to the left. Add to that there is a past history of market choppyness or structure. Nothing really dead on but as a whole that area looks prime for something. I personally don't have anything in my rules to trade this strictly on what I see now. But if price action does get down to that general area I will switch down to a lower time frame and see if I can catch a double bottom and get involved. If not then I just sit back and watch and call in a learning experience. My goal is not to lose money so if I'm not 100% comfortable with a trade set up I simply sit back and watch.

This post is a follow up to the "Training Over Trading" post that should be right under this one. In that post I predicted a trade setup but didn't take it because I didn't feel comfortable using live money on it yet. rather I decided to use it as a training exercise that would help me in the future when it comes to creating rules and putting it in my trading plan for the future. If you compare charts you'll see that the trade in fact played out in a profitable way. The 3 lines on the side are the possible targets that I would have used. Target 1 would have been collected at a retest of the base of the original entry for around 230pips. Target 2 would have either been at the Fibonacci confluence level banking 390 pips or if I'm aggressive I would continue to trail stops in hopes of an AB=CD completion for around 600 pips. I've learned the hard way, not to get greedy in this market, take your profits and ride out. But if enough testing is done, I'l be able to see which target has the most probability of being hit and create my exit rules around that data. That's a long ways away and a lot of hours of testing away, but that's what goes through my mind when looking at adding something to my trading strategy.

This is the trade setup I was talking about in the post titled "training Over Trading". Here is what I was looking at. At the top of the screen we have a structure high which proceeded to rollover. I took a Fibonacci retracement of this move and saw that the 0.618 came in at a nice looking structure area. At this point I told myself that there was a good chance that the market would be sucked into this point and then either reverse back down on or continue to go up. Because I would have been presented with a great risk/reward ratio it would have been a worthy trade to risk 1 to gain 2. If I was trading live I would have went down to a smaller time frame to get the best entry possible and Target 1 would have been where price action is at in the picture above. Target 2 would then be at the completion of the potential ABCD pattern. If you read my post, then you'll know that I didn't trade this setup live, but I did learn a lot from it.

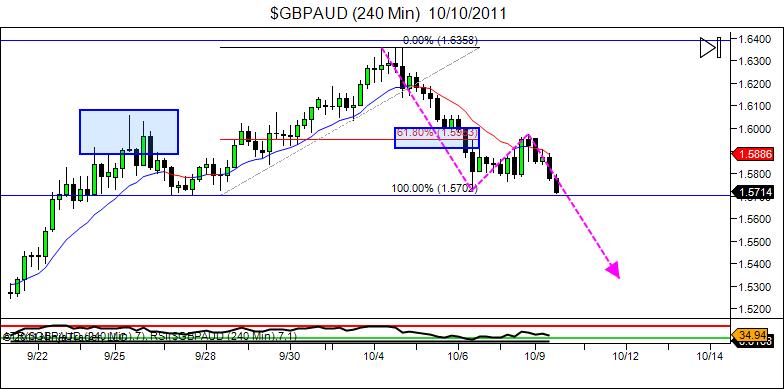

If you don't believe in the power of ratio's and market harmonics juts take a look at this chart. All of this happened before I was awake this morning, but if you follow the pink lines you'll see a larger AB=CD pattern completing at a 141.4 fib extension & 161.8 fib inversion zone, only to be followed by a smaller AB=CD pattern that completes at similar ratio confluence. Amazing how this stuff occurs. All that's needed is the skill to recognize it beforehand and the confidence to trade it. And a good set of rules of course.

Not much on the table for me trade wise today. Got stopped out for small profits on the 2nd targets of 3 trades last night. So today it's time to refocus and analyze for the future once again. IF this AB=CD pattern completes (we never know of course) it should end at a point of major support (1.3840's) This could be a great place to start looking for reasons to get short if the opportunity presents itself.

|

RSS Feed

RSS Feed