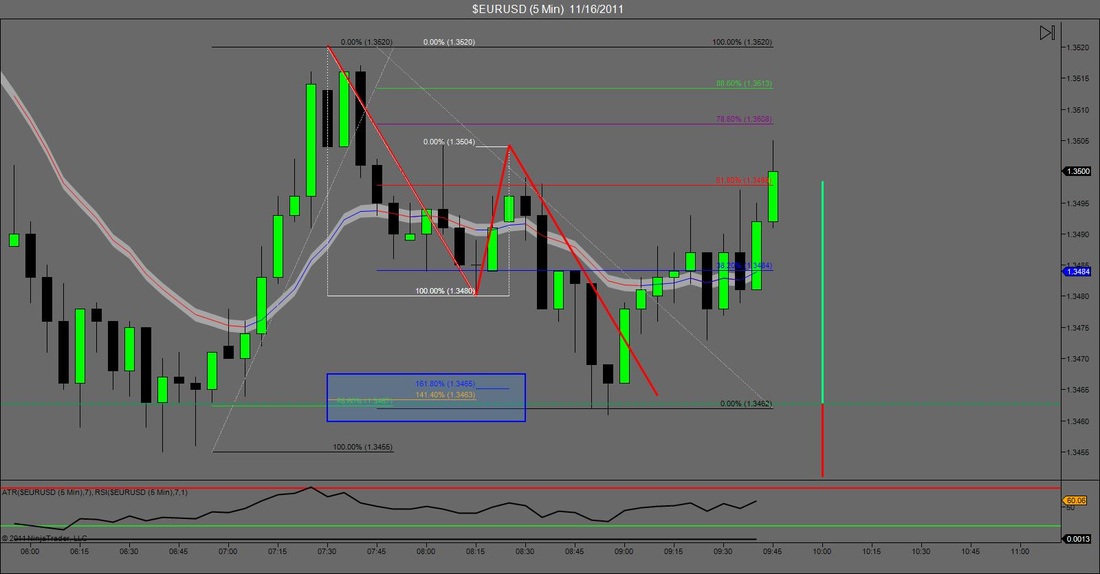

On the EURUSD 15min I was originally looking for an advanced pattern such as a gartley or a bat. However the market retraced too far to give me a valid signal by my rules. So I decided to zoom down to the 5 min chart and as always started drawing AB=CD patterns. I noticed that if it was going to complete it would stop right at the previous retracement which I deemed as structure. I then drew in some fibonacci extensions, inversions and a retracement from the original move and as you can see they all lined up at the same area. Needless to say I got involved. The rest speaks for itself.

So the coolest thing happened today. I was attending a free webinar hosted by a great trader named Todd Brown from Triple Threat Trading. In this webinar he brought up a chart from a former client and told me that I might be interested in looking at it since I am a ration based trader as well. When looking at the chart I noticed that it looked familiar and when looking back at my screen I noticed that I indeed was already involved in the exact same trade and the exact same point, and had already hit profit as well. I personally never try to base my trades off others analyses but it was pretty cool to see that three traders could see exactly the same thing on two different time frames, have the same entry and snag the same profits. Anyway let's take a look at the actual trade.

On the EURUSD 15min I was originally looking for an advanced pattern such as a gartley or a bat. However the market retraced too far to give me a valid signal by my rules. So I decided to zoom down to the 5 min chart and as always started drawing AB=CD patterns. I noticed that if it was going to complete it would stop right at the previous retracement which I deemed as structure. I then drew in some fibonacci extensions, inversions and a retracement from the original move and as you can see they all lined up at the same area. Needless to say I got involved. The rest speaks for itself.

0 Comments

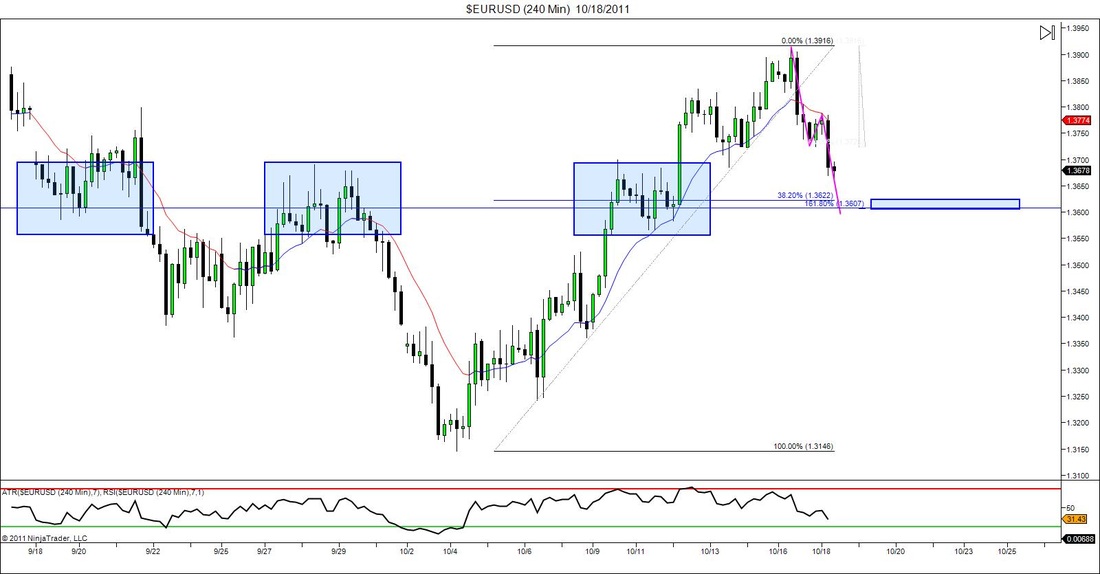

I have noticed a massive amount of ABCD patterns forming this week in the market on many different time frames. I through this chart on because it serves as a really good example since it completes at structure and some Fibonacci ratios as well which makes it an even better opportunity. Also if you look to the left of my red marks in the bullish direction there is another ABCD completion which I believe I had marked off as a part of a advanced pattern. These things are everywhere, the hard part is finding them before they complete and having the courage to follow your rule sand get involved.

My trading mentor Jason Stapleton of http://www.triplethreattrading.com/ taught me the most important goals in trading was not to go broke. With that goal constantly on my mind I am always looking for reasons to protect myself in the market. This chart represents a trade that I took on Tuesday maybe. I forgot my exact reasoning but I know it was valid since I got involved. I think it was and AB=CD at 2 Fibonacci points along with the obvious structure & RSI divergence that you can see in the chart. Anyway, back to the topic of protection. Last night I decided to check on this chart before going to bed and I saw that price action had broken and closed above the previous high. This pleased me because I was able to move my stops up from was initially around a 90pip stop to being a 50pip stop. When checking the charts again this morning I saw that another new high was created and was able to move my stops up again to what was break even for me putting me officially in the safe zone. I call it the safe zone because at this point in this trade I can't lose money. Best case scenario, price keeps moving and I hit some profit targets. Worst case scenario, I get stopped out for break even and I avoid a losing trade. Either way it's free money i'm playing with now. After about a year of trading I'm noticed that trade management and knowing how to correctly protect yourself in the market is probably more important than simply being able to identify trade opportunities.

Not much in the market I'm excited over but that doesn't stop me from drawing in lines and practicing my technical analysis. After-all it is a skill. Anyway with this chart I simply drew in a "What If" AB=CD pattern and saw that would indeed complete at a 1.618 fib extension which is always a good sign. this extension also lines up in an area very close to a 38.2 retracement level of the impulse leg to the left. Add to that there is a past history of market choppyness or structure. Nothing really dead on but as a whole that area looks prime for something. I personally don't have anything in my rules to trade this strictly on what I see now. But if price action does get down to that general area I will switch down to a lower time frame and see if I can catch a double bottom and get involved. If not then I just sit back and watch and call in a learning experience. My goal is not to lose money so if I'm not 100% comfortable with a trade set up I simply sit back and watch.

I just wrote a post under the "Follow A Pro Trader" Blog with the same title. For a description of this chart please read that post.

Here is a picture of a trade that I took yesterday. When zooming you you can see that a large impulse leg was formed that hit a point of major structure support (from the past). It then retrace a little bit and came back down to re-test that same area. After seeing the RSI divergence on this trade I became the perfect opportunity to get a low risk entry. Low risk meaning that I would have a good risk/reward ratio (amount that I could gain compared to the amount that I could lose). After the market wiggled around a little bit I was able to move my stops up a bit to save myself from a bigger than necessary loss if the market decides to reverse. Trade management is just as import as spotting good trading opportunities.

Not much on the table for me trade wise today. Got stopped out for small profits on the 2nd targets of 3 trades last night. So today it's time to refocus and analyze for the future once again. IF this AB=CD pattern completes (we never know of course) it should end at a point of major support (1.3840's) This could be a great place to start looking for reasons to get short if the opportunity presents itself.

|

RSS Feed

RSS Feed