I'm usually not too sharp at identifying head and shoulders pattern due to the fact that I just haven't put in the time to really train my RAS to identify them quickly. With that being said I am a structure based trader and these patterns often present some very important structural levels which can lead to some pretty decent trend continuation trades whether you're playing the breakout or the bounce.

0 Comments

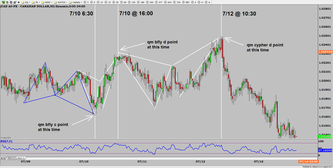

I decided to have a little fun tonight while doing my market analysis. While looking at the EURJPY, I drew out about 3 potential trading opportunities and it brought me back to my earlier trading days where something like this would freak me out. Do I wait for the Bat? Do I take the potential double bottom long? Is this Cypher pattern even valid due to that reactionary spike caused by this mornings ECB Conference? Going back to the post that I wrote this morning ("Learning The Language") this is a great example of one of those mental battles that a trader faces on a dail

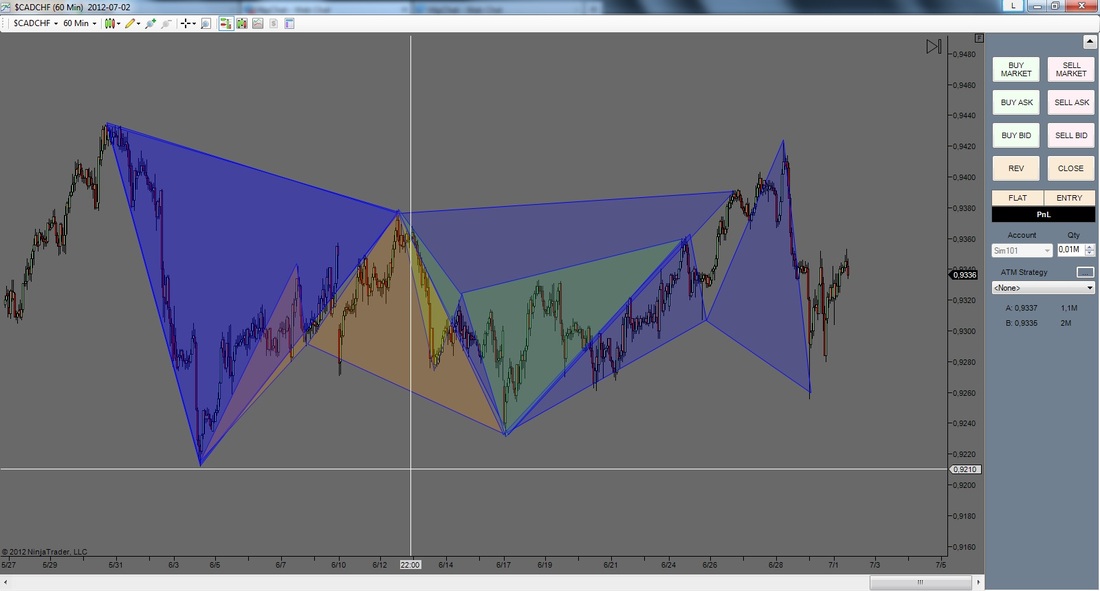

Just some more examples of Market Art provided to me by some of the members (Per & Andre P) of the Mastermind group that I'm involved with.. One of the mistakes that many traders make is to shut down a chart after a pattern has been completed. However (especially with the Cypher pattern), it is very important to keep an eye on the bigger picture because you never know when the "C" leg of one pattern could be the "A" of another pattern. Or the "D" completion of one pattern could be the aggressive "C" of the next pattern.

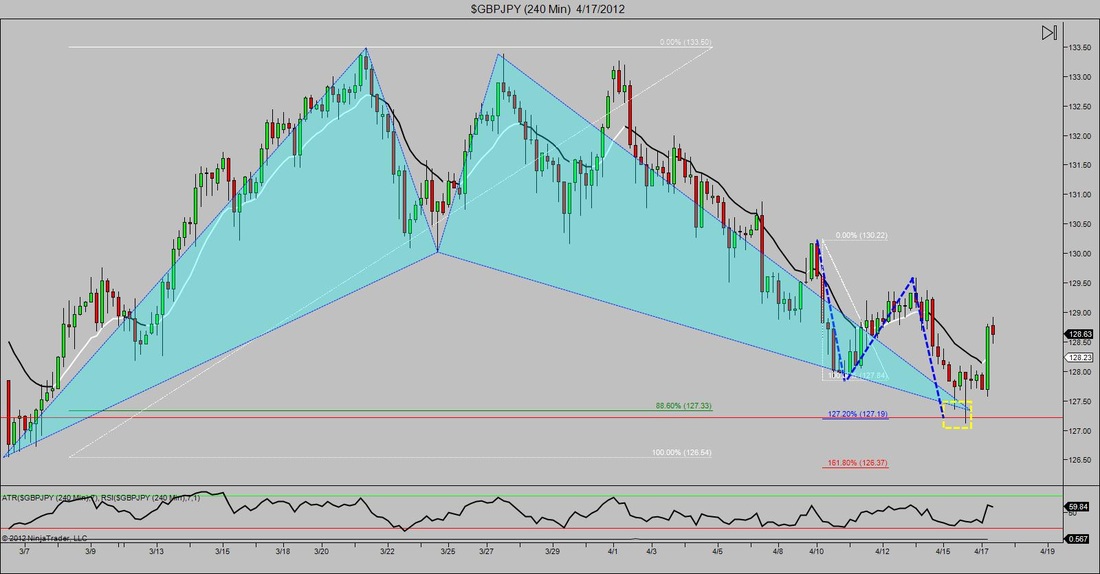

This was a pretty cool setup that one of the traders in the live room brought to my attention yesterday. This was one of those trades where the market simply left the money on the table and walked away daring us to grab it. In the chart above we have a 3 drives pattern along with 5 points of Fib confluence. Add to that the fact that the market stalled and traded sideways right at this area for a good 15 candles, I don't think there is any question weather this was a good trade or not.

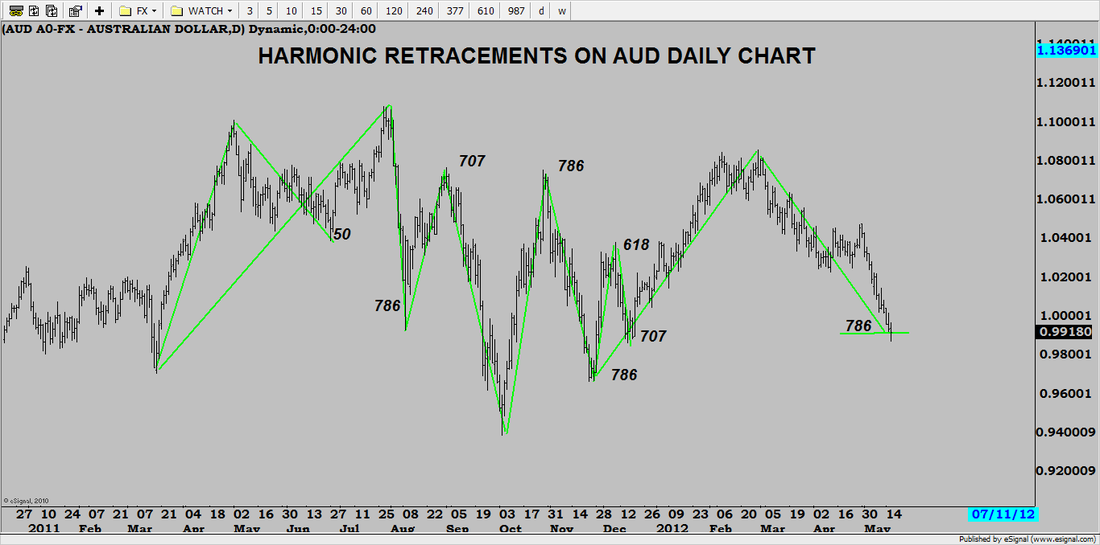

I received this post from a member of the Mastermind group I'm in this morning and thought it was pretty cool. I know that we've all noticed how the market likes to make harmonic moves but it's pretty dang cool when the same retracement level is also hit time after time.

Hey guys, my friend Andre has blessed us once again with a few charts demonstrating how REAL market harmonics actually are. The second chart shows a great example of how patterns form within, before and after other patterns. He had another example that was even better, but it involved the NEW Cypher Pattern which isn't available to the public let. Word on the street is that Jason Stapleton will be going over it in the International Traders Workshop this week. I'm not sure what day, but it ends on Friday. Anyway enjoy traders and a big thanks to Andre for scoping these out for us.

Link to the International Traders Workshop http://triplethreattrading.com/rms2012/ Hey traders, it's been a while since I've done a chart talk post as most of my analysis has been going towards "Syndicate" members. However, I was able to pull something up today that I thought would make fro a great lesson. Have you ever had a trade that looked very attractive but for one reason or another didn't meet your rules for entry? Because I have pretty strict rules on what levels my advanced patterns need to hit, I often am faced with this issue. The chart below is an example of a bat pattern. Now in this case my rules were hit but for the sake of this post let's pretend that they were not. Even though the pattern may have not triggered your rules for entry you'll notice that before it completes another pattern is formed. An AB=CD completion at the exact level that your bat entry would be at. Therefore even though you can't "officially" trade it as a bat pattern, you can get the same type of trade off of a CTS type trade looking at the ABCD at fib confluence. This just goes to prove that you should never give up on a trade.

Sometimes you just need to ask heavyweight questions. If you listen to Jason speak often enough you realize he seems to have a gift for that.

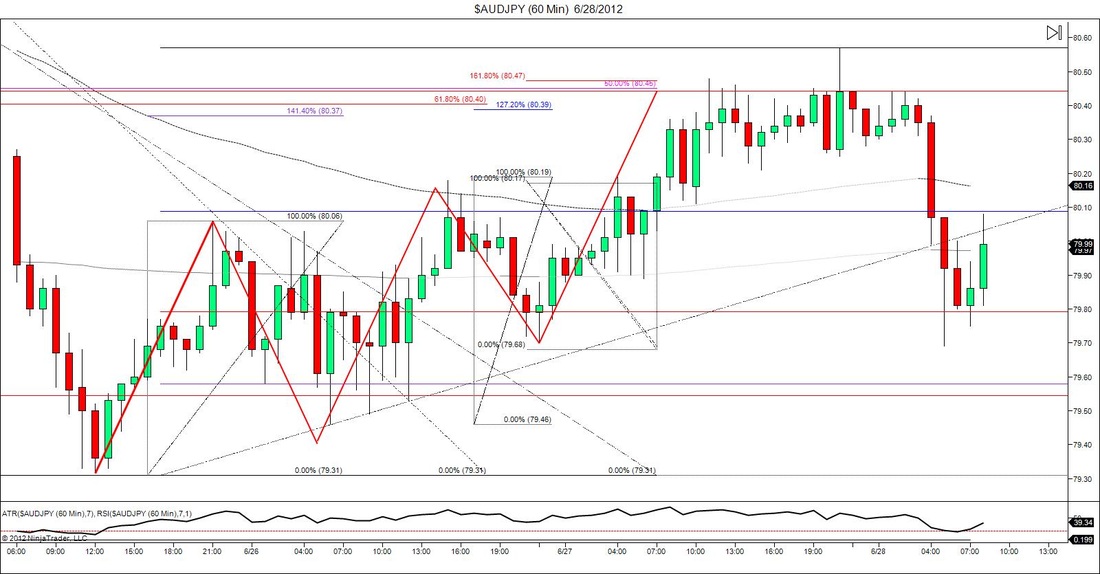

Recently in a training session for Syndicate members Jason asked one of his classics: “How can you expect to be a consistently profitable trader if you are not consistent in how you trade, in how you approach the markets day in and day out?” Sounds like a remarkably simple question? Most heavy questions have that ring about them. And most heavy questions require a heavyweight answer. Ironically, asking a few more questions may help us arrive at a heavyweight answer. For example, you may ask, ok how do I gain consistency? In order to have consistency you need to have belief in a solid game plan. Ok, so how do I develop a solid game plan and how do I create belief in that plan? A SOLID GAME PLAN COMES FROM RAW TRAINING. BELIEF COMES FROM RAW TRAINING. RAW TRAINING comes from “practice, drill, rehearse”, from doing it over and over and over again, relentlessly, until its second nature. Until it’s easy. CAPISCE. Ok, ok, how do I apply the principle of raw training to my trading? One effective way is to go lower, to go where the repetition is, where it’s so fast and intense if you blink you miss out... lower time frame trading! Akil’s live trading room is designed to do just that. Harmonic events like bats, gartleys, ab=cd’s, crabs, bflys, etc. may sound exotic, but they consistently appear and offer you a clear edge. Being in Akil’s room has inspired me to go lower and what I’m finding is blowing my mind. However, all the talk in the world can’t inspire as much as vivid examples of the real thing. So here I have provided 13 or so lower time frame harmonic events caught by me in real time during the second week of March. The purpose is to show you the incredible repetitive nature of these harmonic events and to impress on you how going to the lower time frame is an intense and quick way to engage in some raw training and some raw trading. So bringing it full circle, in a nutshell, the heavyweight answer is: Repetitive Raw Training! Andre Above is a trade we looked at last week in the Live Room. Obviously I'm a little late posting it (I'll explain why later) but it's pretty cool non-the less. What we have here is pretty simple, it's and ABCD pattern and well...another ABCD pattern. They key is they both completed at the same point (along with some other stuff). A you can see the market respected this point and the traders who entered this trade made some pretty good profit.

So now the question is, why am I bringing this up so late? Just like you guys I've been working pretty hard behind the scenes and recently I was asked to become a contributor to "The 6 Figure Syndicate" program where master trader Jason Stapleton and I give some insider access to our thoughts on the market. Because I don't want to dissappoint our members |

RSS Feed

RSS Feed